“Life can feel like going up shit creek without a PADDLE!” -My younger self.

Contrary to the foregoing, filing Chapter 7 Bankruptcy is not the worst thing in the world.

In fact, it’s not even that bad. “But wait,” “Ruben-Have you lost your mind!? -Bankruptcy, not that bad, “What’s the Catch?”

No catch! Just FACTS.

Foreword

A common misconception, and by common, I mean virtually everyone believes this, is that bankruptcy will existentially ruin them, and that life post-bankruptcy is so damn difficult that someone should only ever seriously entertain bankruptcy as a LAST DYING RESORT.

Dramatic? A little. Overkill? Maybe.

Let’s take these in turn:

BANKRUPTCY WILL RUIN ME

You don’t need to be bankruptcy attorney or expert of any kind really to know that your credit is going to take a MAJOR HIT once you file for bankruptcy.

But does that merit not even considering it?

Of course not.

Generally speaking, bankruptcy is going to stay on your credit report for 10 years.

But does that mean your credit is going to suffer for 10 years? ABSOLUTELY NOT!

In as little as 18 months, your FICO credit report can go from bad credit (less than 579) to fair credit (580-669). Does this happen by itself, in a vacuum, NO WAY JOSE!

You’re going to have to work at it, but is it possible,? You BET IT IS.

BENEFITS OF Chapter 7 BANKRUPTCY ARE NOT WORTH THE COST.

If someone tells you with a straight face that the benefits of bankruptcy are not worth the cost; one, they probably don’t know much about credit rebuilding or any of the other infinite variables involved in post-bankruptcy; or two, their case is very different than yours.

Regardless, take FREE ADVICE with a grain of salt, and always do your own research.

Cost of Bankruptcy: Look. I’m not going to belabor the point, especially with information that seems pretty evident.

In the short term, everyone knows that Bankruptcy will ruin their credit, which means, any credit cards you do in fact qualify for, yup you guessed it, they’re going to come with a high interest rate.

On top of this, you can pretty much say goodbye to qualifying for a loan.

At least on your own and for sometime.

The cost of filing for chapter 7 bankruptcy, is going to run you a few hundred dollars, and if you get an attorney, add another $1,500-2,500.

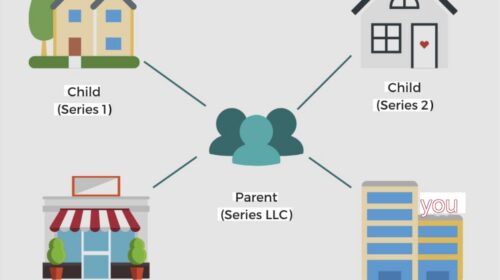

Incidentally, unless your estate is very small and you don’t own things like a home, 401k, IRA, tools of the trade, etc., I would highly urge you to hire a bankruptcy attorney. Trust me, whatever you pay an attorney (within reason of course) to handle your bankruptcy case, will far outweigh the utter disparity and meloncholy you’ll experience, should you go it alone, only to find out that you royally screwed up, and now assets that would have otherwise been safe, are now being seized by the bankruptcy trustee.

Scary? You betcha! –

And more common then you think.

Okay, so now that I’ve scared the you know what out of you, lets talk about the WARMER FUZZIER parts of bankruptcy.

Benefits of Bankruptcy: Fresh start. A redo on life. Clarity. Way less stress. More free time to do the things you like, including not worrying so much. Less work. Clean slate. Positivity. Less anxiety. New beginnings. Hope. HAPPINESS, you GET THE POINT.

Plain and simple, the benefits of bankruptcy are immense!

Think about it, when you’re so deep into the rabbit hole, that ANXIETY is your bestfriend, then YES things are going to get a heck of a lot better the moment you get rid of it.

By “it” debt, collection calls, interest payments, THE PROVERBIAL HELL THAT MOST PEOPLE EXPERIENCE WEEKS, MONTHS, SOMETIMES YEARS, BEFORE FILING FOR BANKRUPTCY.

BUT let’s be real, the scarcest part about bankruptcy, is bankruptcy itself.

I’m not sugarcoating folks!-

For most people, the STIGMA of bankruptcy is the biggest mental hurdle to overcome.

But here’s the thing, and something I could never understand.

If you’re already in the THICK of it, what’s the difference? Is bankruptcy really going to CHANGE things that much? Your credit already sucks, you have tons of debt, and worse, your mental health has taken a NOSE DIVE.

So why not purge yourself from this existential hell, and start FRESH?

Businesses do it all the time! So why not you? Bounce back as a bigger, badder version of yourself, MINUS the DEBT and HEARTACHE!

Final Thoughts

Bankruptcy should not be your first choice. There are credit counseling classes and professionals that are familiar with managing and paying off debt, that can help you in figuring out whether or not you are financially capable of paying off your debt over time.

That said, Bankruptcy should also not be your last choice. A lot of people suffer unnecessarily because of the stigma of bankruptcy, and resultantly, put it off for far too long.

This is absurd! Not to mention, counterproductive.

If you’re stuck in between a rock and a hard place, then stop putting off the inevitable. Wipe the slate clean and start rebuilding.

Most importantly, start doing the things that really matter- Life is short, START LIVING IT!

Leave a Reply