Most people don’t understand the simple truth about entrepreneurship and property ownership: The law doesn’t care about your intentions — it cares about structure.

And when you own property in your personal name or you operate “as yourself” under a sole proprietorship……you are essentially loading a bullet into the chamber, spinning it, placing the barrel to your temple — and pulling the trigger with every deal, every tenant, every video shoot, every subcontractor, every client, every partnership, and every invoice.

One injury.

One accident.

One contract gone sideways.

That’s all it takes. That’s all it takes to expose your personal home, your personal savings, your car, your retirement accounts, your brokerage accounts, your other investments, your other rentals, your other businesses — to the jaws of the legal system.

Sole Proprietor = ZERO Separation

If you operate as a sole proprietorship:

- There is no corporate veil

- There is no separation in identity

- YOU are the business and the business is YOU

Which means:

If the business gets sued, YOU get sued. Personally.

And “I’ll just be careful” is not asset protection. That’s blind faith.

Property Title In Your Personal Name Is Even Worse

Real estate is physically attached to the Earth. It is the single easiest asset for attorneys to attach liens to.

Your personal name on title = YOU are the target.

Personal name = personal liability.

It doesn’t matter if the tenant was wrong.

It doesn’t matter if the guest was careless.

It doesn’t matter if YOU weren’t on site.

If a court believes you had a duty and you breached that duty, like it or not, you and your personal assets are now on the chopping block. CHOP CHOP.

And I don’t know about you, but that doesn’t exactly sound like Disneyland.

If You Want Asset Protection, Structure Is Not Optional

Only entities and contracts separate liabilities.

Here are the REAL tools that make liability predictable instead of fatal:

- LLCs

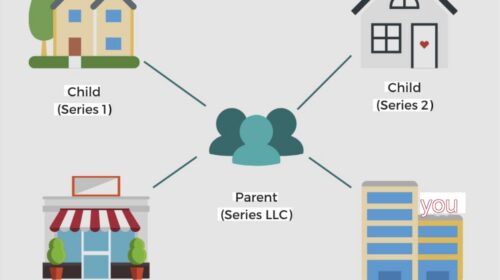

- Series LLCs

- Holding Companies

- Wyoming / Delaware anonymity layers

- Revocable & Irrevocable Trusts

- Fictitious Business Names / DBAs at the operating layer

- Manager-managed structures (not member managed)

- Registered agents and mail drops (not your home address)

- Iron-clad contracts with:

- binding arbitration clauses

- mediation as first step

- attorney fee shifting for frivolous claims

- non-assignment clauses

- confidentiality clauses

- liability waivers

- partial negligence waivers wherever enforceable

This is how REAL operators reduce their surface area.

Not by being careful —but by eliminating attack vectors.

And Yes — Insurance Too (But As The Last Line, Not The First)

Most people rely on insurance alone.

That’s backwards.

Insurance is the catch-net at the bottom of the cliff — not the guardrail at the top.

Umbrella policies, commercial general liability (CGL), errors and omissions (E&O) — these are great.

But they only work well when:

- the entity is structured correctly

- the contracts reduce ambiguity

- the counter-party agreed to the dispute resolution terms

Insurance is not a substitute for structure. It is a supplement to structure.

The Cold Hard Truth

If all your assets are in your name — you don’t own them. They are simply on temporary loan from fate.

- One fall on a staircase

- One subcontractor injures a cameraman

- One tenant’s girlfriend twists her ankle

- One angry client alleges misrepresentation

- One contractor doesn’t carry his own general liability insurance

…and everything you’ve spent 10 years building can vanish in 10 months of litigation.

This is not paranoia.

This is how the system is built.

Stop Gambling. Start Structuring.

The difference between people who get wiped out in lawsuits and people who shrug off lawsuits — is not luck.

It’s entity architecture,

it’s accepting the reality that bad things happen, and

it’s realizing that you are not immune from lawsuits.

Wealth is not only about cashflow. Wealth is also about making yourself a small target.

If you want to protect your family, your savings, your investments, and your future — then you must stop operating as an unprotected individual.

You must stop doing business naked.

Structure is not for the rich.

Structure is how people BECOME rich and STAY rich. Period.

Leave a Reply