Avoid probate. Protect your family. Stay in control.

Owning a home is a major milestone. It’s often the cornerstone of a family’s financial life, and in many cases, it’s the single largest asset a person will ever own. But surprisingly, most homeowners never take the step that truly protects that asset—and their family—when they’re gone. They assume that having “a will” is enough.

It isn’t.

If you want to avoid probate, prevent court interference, protect your children, maintain privacy, and decide exactly how and when your estate is distributed, then a revocable living trust is not just a nice option—it’s essential.

Let’s break down exactly why.

1. A Will Does Not Avoid Probate—A Trust Does

This is one of the most common sources of confusion.

A will is a set of instructions to the probate court. That means when you die with a will—even a perfect, attorney-drafted will—your estate must go through probate. Probate is:

- Slow (often 9–18 months or more)

- Expensive (attorney fees, court filing fees, appraisal fees, etc.)

- Public (anyone can read your will, see your assets, and know who gets what)

- Stressful for families

A will does nothing to avoid these issues.

A revocable living trust, on the other hand:

- Bypasses probate entirely

- Transfers your assets efficiently and privately

- Allows your successor trustee to manage everything without court supervision

With a trust, your estate settles in weeks or months, not years.

2. A Living Trust Keeps You in Control—During Life and After Death

A trust lets you control your estate not just at the moment you pass away, but long after, according to your exact wishes.

You can specify:

- When your children receive assets

- How assets are used (education, support, health, home purchase, etc.)

- Whether distributions are staggered—like at ages 25, 30, and 35

- Protection for a child with special needs

- Restrictions for a child with addiction issues

- Oversight for minors until they reach maturity

A will cannot accomplish this level of control.

Once probate ends, assets under a will are distributed outright—even if the beneficiary is 18, irresponsible, or vulnerable.

A trust ensures your estate plan works the way you intended, not the way the probate court dictates.

3. Putting Your Home Into a Living Trust Will NOT Trigger a Due-on-Sale Clause

Many homeowners worry

“If I put my home into a trust, will the bank call the loan due?”

The answer is no.

Under federal law (the Garn-St. Germain Act), a lender cannot enforce a due-on-sale clause when you transfer your primary residence into your revocable living trust as long as you remain a beneficiary.

This means:

- The lender cannot accelerate the mortgage

- Your monthly payments continue as normal

- Your loan terms remain identical

This protection applies nationwide.

4. Transferring Property Into a Trust DOES NOT Cause a Property Tax Reassessment

California and many other states protect homeowners from losing their low property tax basis when transferring property to their own trust.

As long as:

- You are the trustor,

- You are the trustee (or the trust is for your benefit), and

- The transfer is not a sale but simply a change in title form,

…your property tax assessment stays exactly the same.

This is one of the reasons trusts are the preferred estate-planning tool for homeowners everywhere.

5. A Revocable Living Trust Protects Your Family if You Become Incapacitated

A will only works when you die.

A trust works while you’re alive too.

If you become disabled, injured, hospitalized, or mentally incapable of managing your affairs, your successor trustee can step in immediately—without a conservatorship.

Compare that with relying on a will + power of attorney:

- Banks often refuse to honor powers of attorney

- You may still need court involvement

- Your assets may be frozen while your family petitions the court

A trust avoids all of this. It’s a built-in incapacity plan.

6. A Trust Protects Children and Prevents Family Disputes

A trust can:

- Prevent estranged relatives from challenging your estate

- Protect young children from inheriting money too early

- Keep an ex-spouse away from inheritance

- Prevent siblings from fighting over your home

- Keep generational wealth intact

It is far more resilient than a will in preventing disputes.

7. A Trust Keeps Your Estate Completely Private

Probate is public record. Anyone can access:

- Your will

- Your home address

- Asset values

- Your beneficiaries

- What each person receives

A trust is 100% private.

No public filings. No hearings. No strangers reviewing your family’s financial information.

8. Living Trusts Are NOT Just for the Wealthy

There is a persistent myth that “trusts are only for the ultra-rich.”

Here’s the truth:

If you own a home, you should have a trust.

Period.

A trust is not about wealth— It is about avoiding probate and protecting your family.

Even a modest estate can trigger lengthy, costly probate. In many cases, the probate fees exceed the cost of setting up a trust several times over.

A trust gives regular families:

- Stability

- Predictability

- Control

- Privacy

- Peace of mind

It’s the foundation of modern estate planning—not a luxury.

9. A Revocable Trust Is the Foundation You Build On for the Rest of Your Life

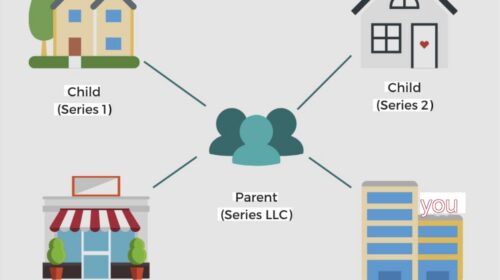

Once you establish a trust, it becomes the legal “container” for your assets:

- Real estate

- Bank accounts

- Investments

- Life insurance

- Business interests

- Rental properties

- Vehicles

- Collectibles

As your wealth grows, your trust grows with you—without needing to redo anything major.

Updates are easy:

- Amend the trust

- Add new assets

- Change beneficiaries

- Replace your trustee

A trust gives you a flexible, long-term structure that evolves with your life.

10. Final Thoughts: Your Family Deserves More Than Just a Will

A will is better than nothing—but it’s far from enough.

If you want:

✔To avoid probate

✔ To protect your home

✔ To protect your children

✔ To control distributions beyond age 18

✔ To ensure privacy

✔ To avoid court interference

✔ To keep your family out of a long, expensive legal process

Then a revocable living trust is the most powerful and accessible legal tool available.

You don’t need to be wealthy. You just need to care about what happens after you’re gone.

And if you own a home—or plan to—putting that home into a trust is one of the smartest, safest, and most forward-thinking decisions you can make for your family.

Leave a Reply