Most business owners spend their energy building, expanding, and optimizing their companies. They fine-tune marketing strategies, negotiate supplier contracts, and hire the right teams. But there’s another side to entrepreneurship — one that doesn’t show up on the highlight reels; and that’s protecting what you’ve built, so that when the storm hits your not left out to dry. And believe me, the storm always hits. The only question is, the scale.

In today’s litigious society, it’s not enough to make money — you have to protect it. Whether you run a construction company, a real estate firm, a retail brand, or an online enterprise, one lawsuit or one contractual misstep can wipe out years of progress. That’s why asset protection, damage mitigation, legal anonymity, and strategic structuring aren’t just for the ultra-rich — they’re “survival tools” for every serious business owner.

The Silent Threat: Lawsuits and Liability

Every successful business becomes a magnet for attention — not just from customers, but from opportunists. It could be a slip-and-fall at your store, a vehicle accident involving an employee, or a customer who claims a ‘breach of warranty.’Even if you’ve done nothing wrong, defending a lawsuit can easily cost a hundred thousand dollars. And if you’re structured poorly — for example, operating as a sole proprietor or having all your entities under your personal name or just one LLC — plaintiffs’ attorneys will see you as a walking ATM.

With a simple public records search, an attorney will find your real estate holdings, and map your assets before the first hearing ever occurs. That’s where asset protection comes in.

The Core Concept: Separation, Layering, and Distance

Asset protection isn’t about hiding assets or evading taxes. It’s about legally separating ownership, control, and risk, so that one bad event doesn’t penetrate your entire portfolio. The rule is simple: ‘What happens in one company should stay in that company.’ Think of it as Old Vegas, before smart phones and social media.

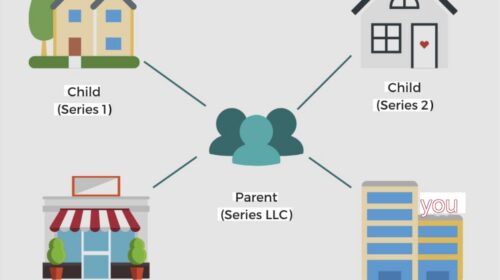

Simply put, if your marketing business gets sued, it shouldn’t endanger your rental properties. If one property burns down, it shouldn’t drag your other LLCs into the lawsuit. If someone wants to sue you personally, they shouldn’t even know what you own. This is accomplished through layering: LLCs isolate liabilities, holding companies own operating LLCs, and trusts can own the holding company to add a layer of privacy and estate planning.

A Hypothetical: The Case of “Samantha” and the Silent Fortress

Imagine Samantha. She owns a small but successful chain of specialty coffee shops in California called Blue Ember Coffee. At first, she operated everything under one entity — Blue Ember Coffee, LLC. In 5 short years, business is booming: three locations, 45 employees, and solid profits. Then, one day, a delivery driver slips in the parking lot of Samantha’s Orange County location, fractures a hip, hires an attorney, and demands $750,000. It doesn’t take long before the attorney’s investigator pulls Samantha’s business filings and discovers her personal name on the LLC. He goes on to find her real estate holdings and even her home address. Within 24 hours, the attorney now knows exactly what to target. Now imagine an alternate scenario. Samantha’s attorney had restructured her empire: a Wyoming Holding Company owns her California LLCs, a Family Trust owns the holding company, and each store carries separate insurance and bookkeeping. When the same lawsuit hits, the attorney finds nothing worth pursuing beyond the single entity’s insurance. The lawsuit settles quickly — Samantha’s fortress holds tight. Other than minimal damage, maybe in the form of higher insurance premiums, Samantha gets out of this relatively unscathed.

Trusts: Privacy Meets Estate Planning

Trusts aren’t just for inheritance or the wealthy. They’re powerful privacy and control tools for business owners. When a revocable living trust or irrevocable trust owns your holding company, your name no longer appears in public filings. You still control everything — but from behind the curtain. Certain trust structures, like Wyoming or Nevada asset protection trusts, can even offer creditor protection while doubling as estate planning tools.

The Insurance Layer: Your Legal Shock Absorber

No structure is bulletproof. That’s why insurance remains the ultimate financial firewall. A layered protection strategy often includes general liability, professional liability, umbrella, cyber, and landlord insurance — each LLC having its own policy. The key is coordination — ensuring your entity structure and your insurance policies align.

Why Anonymity Works: Staying in the Shadows

Anonymity isn’t secrecy — it’s deterrence. When plaintiffs and their attorneys can’t see the size of your empire, they’re less likely to spend their time and money attacking you. Public visibility breeds lawsuits; anonymity breeds negotiation. By keeping ownership private through holding companies, trusts, and registered agents, you transform from an easy target into a moving shadow.

Building the Fortress

Think of your business empire as a fortress with multiple walls:

- Trust – Owns the holding company; adds privacy and estate planning.

- Holding Company – Controls LLCs and limits personal exposure.

- Operating LLCs – Handles daily operations and contains risk.

- Insurance – Absorbs early financial shocks.

- Formalities – Separate bank accounts, contracts, and records prevent veil piercing.

The Expansion Factor

If you plan to grow or franchise, your risk multiplies. Every new employee, lease, and product line increases exposure, and not the good kind of exposure either. Without structure, one bad event could sink your entire brand. With structure, problems remain isolated — inconvenient but survivable.

Growth without protection is gambling; growth with structure is strategy.

Conclusion: Wealth Defense Is a Business Strategy

Whether you’re running a single-location shop or an expanding company, asset protection is not optional — it’s good business, sensible, and yes when shit hits the fan, it’ll be your saving grace too. When you structure correctly, use trusts, implement layered insurance, and stay off the public radar, you gain the ultimate advantage: freedom. Freedom from fear of lawsuits. Freedom from overexposure. Freedom to build boldly. And most importantly, FREEDOM to sleep good again, without fear that one wrong move will wipe you out. Who wants that head trauma anyway.

In closing, like Samantha, your fortress doesn’t have to be flashy — it just has to be invisible, disciplined, and ready.

Leave a Reply